We’ve been looking out for good budgeting apps, since so lots of our readers are searching for methods to economize, funds higher, or simply be extra aware about how we spend and what we spend on. So we reached out to the editors at Apple to see their favorites, and we had been so joyful to see loads of our staff’s personal favorites on their record.

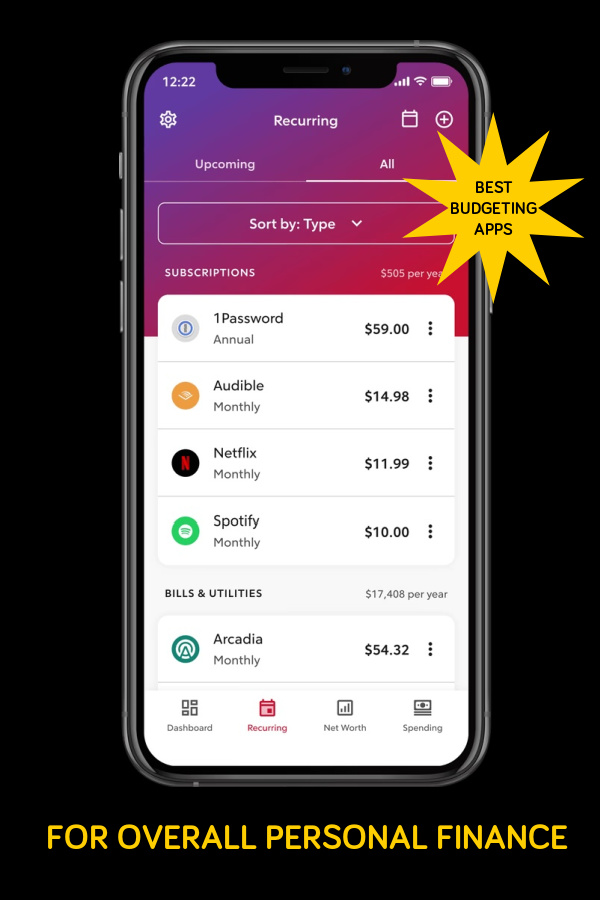

For an all-around private finance app that will help you handle and get monetary savings, you’ll be able to’t go fallacious with the wildly common Rocket Cash app (previously Truebill). It syncs together with your financial institution accounts that will help you monitor revenue and spending, and there’s a strong budgeting function that will help you set saving targets and even hunt down the locations you would possibly have the ability to trim your funds. You possibly can even use their invoice negotiation service do you have to want some assist tackling a giant telephone invoice or pay much less for web.

Additional cool: The app helps you discover and monitor any paid subscriptions you might need forgotten about and cancel them. Say, that 7-day free trial to a streaming service that you simply forgot to cancel after you binged that one collection? Been there, overspent on that.

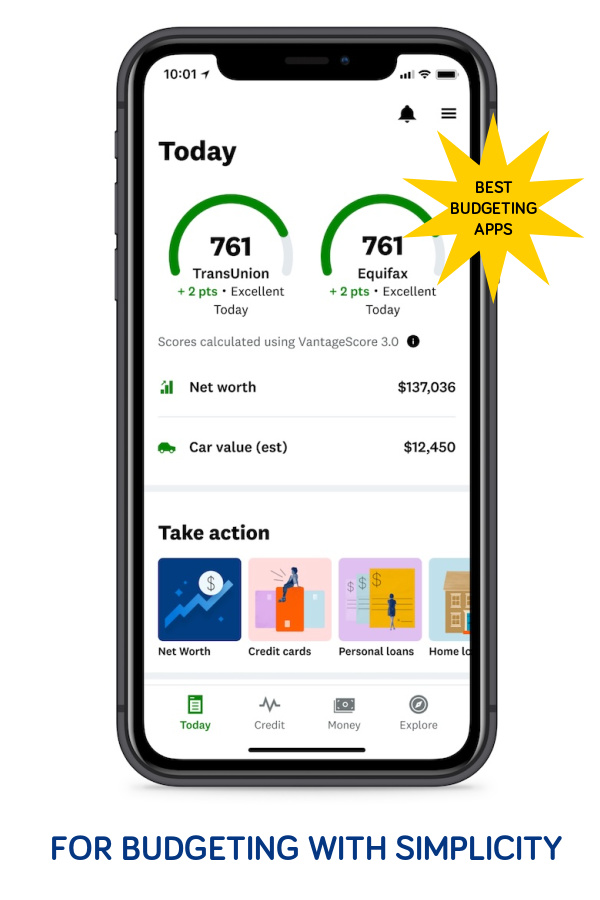

For Budgeting with Simplicity: Monarch App

In case you’re one of many individuals mourning the lack of the Mint app for expense monitoring, customers appear to have discovered a brand new favourite within the Monarch App. Not solely do the Apple Editors find it irresistible, but it surely was named the perfect budgeting app by the Wall Avenue Journal this 12 months and it’s clear why. It’s a easy, fantastically designed app that will help you handle cash and monitor bills in methods which might be custom-made to your wants, and really straightforward to make use of — particularly for {couples} and households. And we’re all the time suckers for a colourful, well-designed app.

Customers love the versatile budgeting instruments lists that monitor your deliberate spending by class, then present you whether or not you’re near hitting your restrict — or have just a little further money to roll over into one other class, or use to repay some debt.

General, it actually helps you see each the massive image and the day-to-day particulars. They’ll even make it easier to alter your private funds in the event you get just a little off monitor. No guilt journey both.

Additional cool: Monarch has lately added a function that permits you to use a calendar view to take a look at upcoming costs, subscription renewals and payments, which is nice for visible thinkers.

Associated: An age-by-age information to instructing youngsters about cash

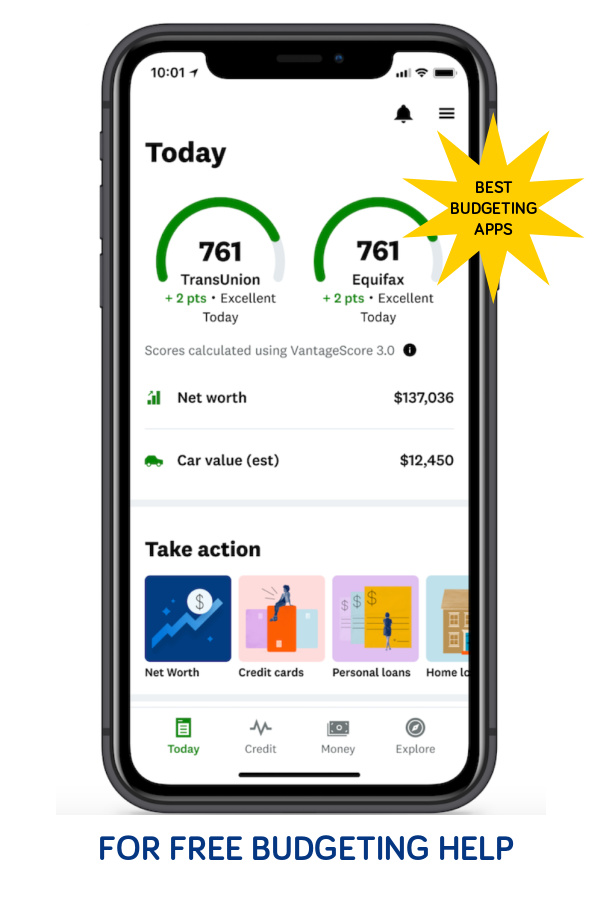

For Completely Free Budgeting Assist: NerdWallet App

Arguably the perfect free app for budgeting — with no strings hooked up — remains to be the NerdWallet App. It’s been a go-to for years and retains enhancing. Join your entire monetary accounts, and also you’ll immediately get an outline of your spending habits, credit score rating, payments, bills, and monetary well being so you’ll be able to handle your money stream now and sooner or later.

It’s straightforward to check spending by class or month-to-month, and will be enlightening in the event you’ve by no means taken a very good take a look at these breakdowns. It’s pretty no-frills, however completely automated and effectively–designed. One be aware: There are advertisements and gives (which may be related), however did we point out free?

Additional cool: NerdWallet is wildly straightforward to make use of, even for these new to a budgeting app. In truth, it’s an important starter app for teenagers or school college students to get into good cash habits early.

Associated: This new website helps mothers earn reward playing cards by answering surveys and taking part in video games.

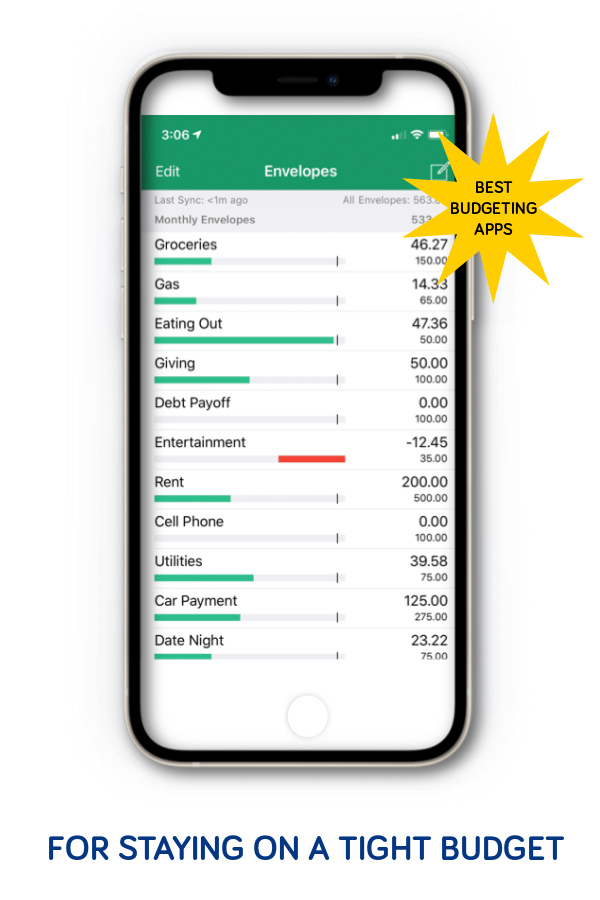

The Goodbudget Funds Planner is an excellent user-friendly, low-tech (in a great way) cash and expense monitoring app that’s designed across the envelope budgeting methodology — solely the envelopes are digital. This fashion you’ll be able to see how a lot is left in every “envelope” every month earlier than you spend it. The app connects to your financial institution accounts if you wish to monitor balances and bills in a single place, plus gives options like in-app stories that will help you kind your spending and see the place you’ll be able to journey or alter, a debt progress tracker to assist with paying off loans or bank cards,

Additional cool: Goodbudget is improbable for households and {couples} as a result of it really permits you to sync and share your budgets with another person. This fashion you’ll be able to keep on the identical web page in terms of how and the place and the way a lot to spend.

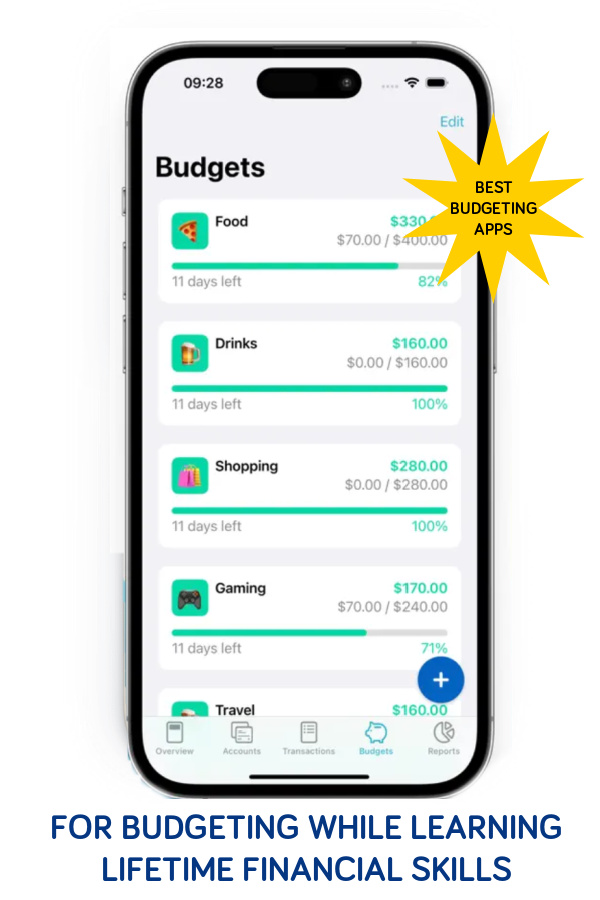

The MoneyCoach My Funds Planner App is that uncommon, super-popular, and extremely advisable monetary app from an revolutionary small enterprise as a substitute of an enormous company — which might be why they’re so good at serving to you if you’re in that world of freelancers and irregular income-earners too.

The aim is to cut back your monetary stress and make it easier to develop your monetary expertise for the longer term, whereas supporting your budgeting and cash administration wants proper now. Like the opposite budgeting apps right here, it tracks all of your accounts in a single place and gives a number of methods to look at your spending habits; but it surely makes use of machine studying to get smarter about you individually, and employs AI-powered ideas to make you smarter too.

The stay forex change instrument is useful in the event you journey. I additionally just like the real-time internet value tracker, which helps you to see how a lot cash you’ve in whole, and the development over time. Very useful in the event you’re filling out these FAFSA types for a school pupil this fall. (Eek.)

We should say they do overstate a few of the options (“Use the mighty energy of your finger to entry Cash Coach with contact ID”) however customers are actually proud of MoneyCoach, and Apple has been highlighting it going again to their 2020 developer convention.

Additional cool: You possibly can improve to MoneyCoach Premium for Sensible Budgets constructed round monetary mindfulness, which supplies you precedence buyer help, incognito mode (sneaky), and a few further options they declare can prevent as much as $2k every year.

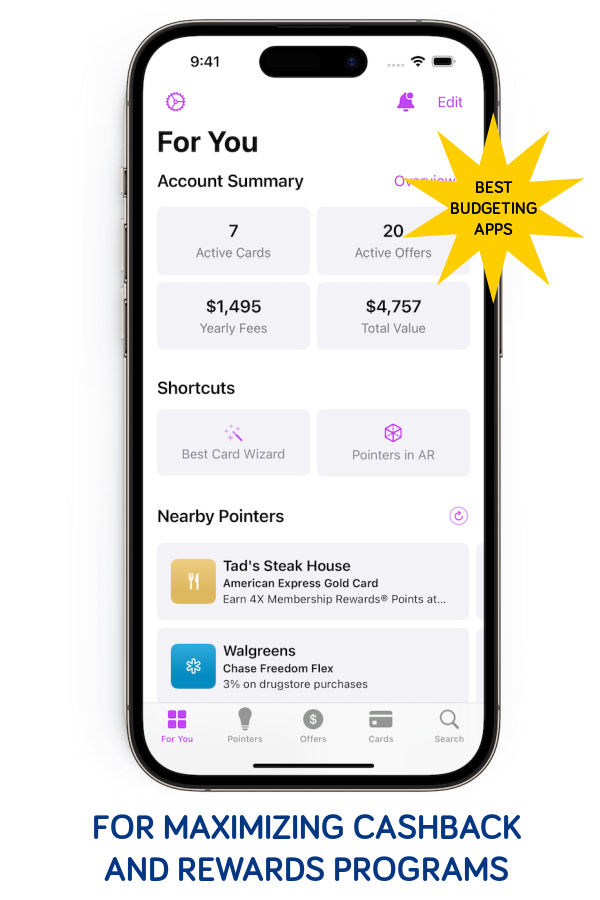

Fan of rewards and cashback applications? Who isn’t! The Card Pointers for Credit score Playing cards app an important budgeting app in the event you’re large on saving cash via cashback, factors, spend bonuses, and miles/rewards earned together with your credit score and debit playing cards.

Customers say it’s like having somebody faucet you on the shoulder on the money register and telling you whether or not try to be swiping your Amex, Chase, or BofA card to get the perfect supply from it. In truth, they monitor the rewards in actual time from over 5,000 totally different playing cards — although hopefully you don’t have all of them. It may additionally ship alerts about expiring gives, and auto-add new ones to your account so that you don’t need to personally scan every program each month to see what’s new. (I all the time overlook until I catch an electronic mail reminder.)

Card Pointers claims to save lots of most customers a mean of $750 or extra every year via cashback, supply alerts, and further rewards and factors — and that’s severe financial savings.

Additional cool: Card Pointers has a Safari Internet Extension that permits you to maximize your on-line purchasing from dwelling, too.

Associated: This new website helps mothers earn reward playing cards by answering surveys and taking part in video games from dwelling.

![]()

For Getting Again Each Penny From Automobile Mileage Reimbursements: MileIQ Mileage Tracker App

In case you drive your personal automotive for work, the MileIQ Mileage Tracker App is a improbable budgeting app and never solely saves you cash, it may prevent a lot time. The app routinely tracks your drives so you’ve a correct mileage log for reimbursement at your job, or a correct receipt on your taxes

You simply have to recollect to swipe proper if you hop within the automotive if you wish to monitor enterprise journey (swipe left for private) and the app will run within the background. That method you received’t miss out including a 100 mile round-trip to your expense stories or itemized tax deductions — particularly contemplating the 2024 IRS charge is $.67/mile in 2024.

Additional cool: The free model permits you to monitor as much as 40 drives a month so you’ll be able to see if it is sensible for you. In case you drive greater than that for enterprise, the $5.99/mo will simply pay for itself in deductions.

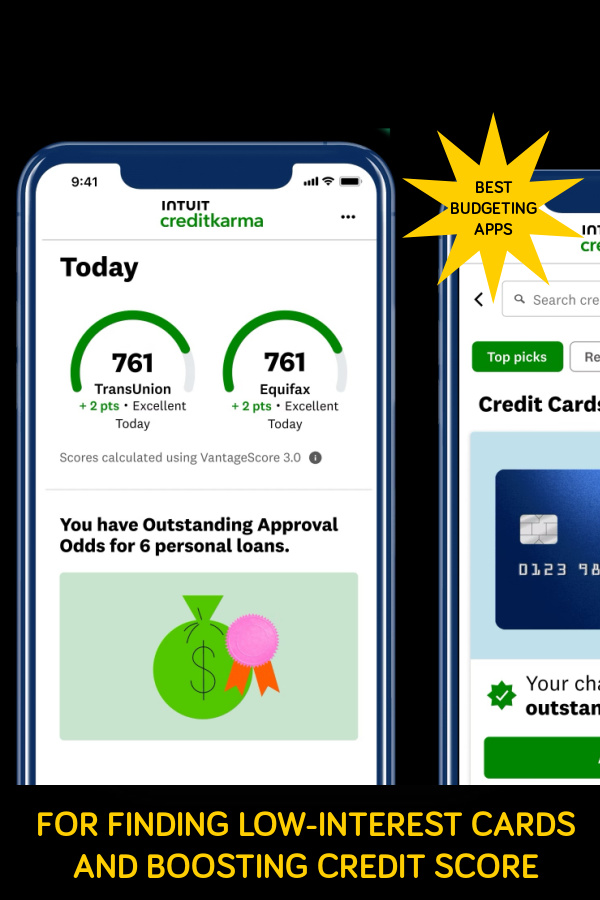

For Discovering Low-Curiosity Credit score Playing cards and Boosting Your Credit score Rating: Intuit Credit score Karma App

In case you’re working towards a mortgage or refi and must get your credit score rating up, Intuit’s Credit score Karma App is the best way to go. It permits you to join all of your accounts so you’ll be able to monitor transactions, spend, and total internet value in a single place, so it’s simpler to search out methods it can save you cash and pay down debt. It in fact consists of free credit score monitoring, so that you’ll know the way you’re doing, and shares suggestions so you’ll be able to maintain that rating climbing. In truth, they declare you’ll be able to increase a low rating by a mean of 21 factors in 3 days.

Additional cool: The app will present you the perfect bank card offers and private mortgage gives that you simply qualify for, so that you will be positive you’re getting essentially the most rewards you’re entitled to, whereas paying the bottom attainable curiosity on balances.

‘

For Maximizing Your Tax Refunds With out an Accountant: TurboTax App

Additionally from Intuit, the TurboTax App is principally everybody’s go-to app for DIY taxes for good motive: It’s not solely straightforward to make use of, however they assure that you simply’ll get the utmost refund allowable utilizing their instruments.

In case you’re one of many 37% of 1040 filers, taking the usual deduction, you should utilize the free model of the app with step-by-step directions and built-in calculators. If in case you have extra difficult taxes, investments, and itemized deductions, get assist from tax consultants stay when you e-file beginning at $89 — which features a skilled assessment of your taxes earlier than you ship them in to allow them to catch any attainable errors. Simply in case. And I really like that you should utilize the identical tax preparer every year, in the event you’re proud of their outcomes.

Additional cool: You’ll get the quickest attainable refund direct-deposited proper into your account utilizing TurboTax. They provide a lifetime assure for 100% accuracy, that means ought to you’ve any accounting errors, they’ll pay the charges eternally. Even in the event you get audited years after you cease utilizing the app.

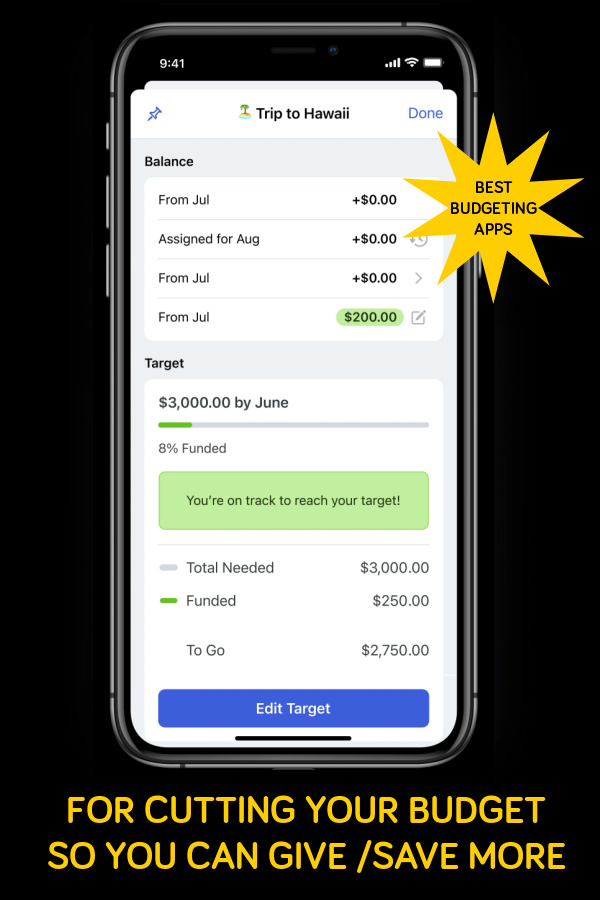

For Reducing Spending So You Can Give Extra (or Save Extra): YNAB You Want a Funds App

The YNAB App makes use of the tagline “Spend, save, and provides joyfully” and that sounds nice to us. It is a subscription-based app constructed to vary each your spending conduct in addition to your mindset round cash, so to spend with extra objective, save with aspirational targets in thoughts, and even have sufficient to offer generously.

It’s designed for companions and households of as much as six individuals to share budgets below one subscription, so that you’re all working collectively towards widespread targets. Options embrace expense monitoring, goal-setting options, debt/mortgage calculators that will help you see how a lot curiosity you save by paying just a little extra every month. And clients rave in regards to the customer support and assets like stay workshops, guides, and movies that actually assist them flip new behaviors into wholesome cash habits.

Additional cool: Whereas a subscription is at the moment $9.08/month (that’s primarily based on the low cost of 1 annual fee), some customers declare to make it again by rather a lot — on common, they’re saving as much as $600 by their second month, and $6,000 a 12 months. Begin with the one-month free trial. then spend your cash. Or extra importantly, easy methods to spend your life.